Toronto Mortgage Stress: A Mounting Concern in 2025

Toronto mortgage stress is growing in 2025 as renewals raise payments. Learn how homeowners are coping and how to reduce stress with smart strategies.

Leverage my 35 years of expertise and knowledge in the Toronto real estate market to achieve your property buying and selling goals. In my blog posts, I share actionable tips and insights to help you understand mortgages and get the best return on your investment.

Toronto mortgage stress is growing in 2025 as renewals raise payments. Learn how homeowners are coping and how to reduce stress with smart strategies.

Navigate Canada mortgage changes, effective Dec. 15, 2024, to learn how updated rules impact buying, renewing, and affordability in Toronto.

Navigating the advantages and drawbacks of choosing a 30-Year Amortization for your mortgage, tailored to Toronto’s unique real estate trends.

How the Bank of Canada’s 50 basis point interest rate cut impacts Toronto’s real estate market, with insights on benefits and challenges.

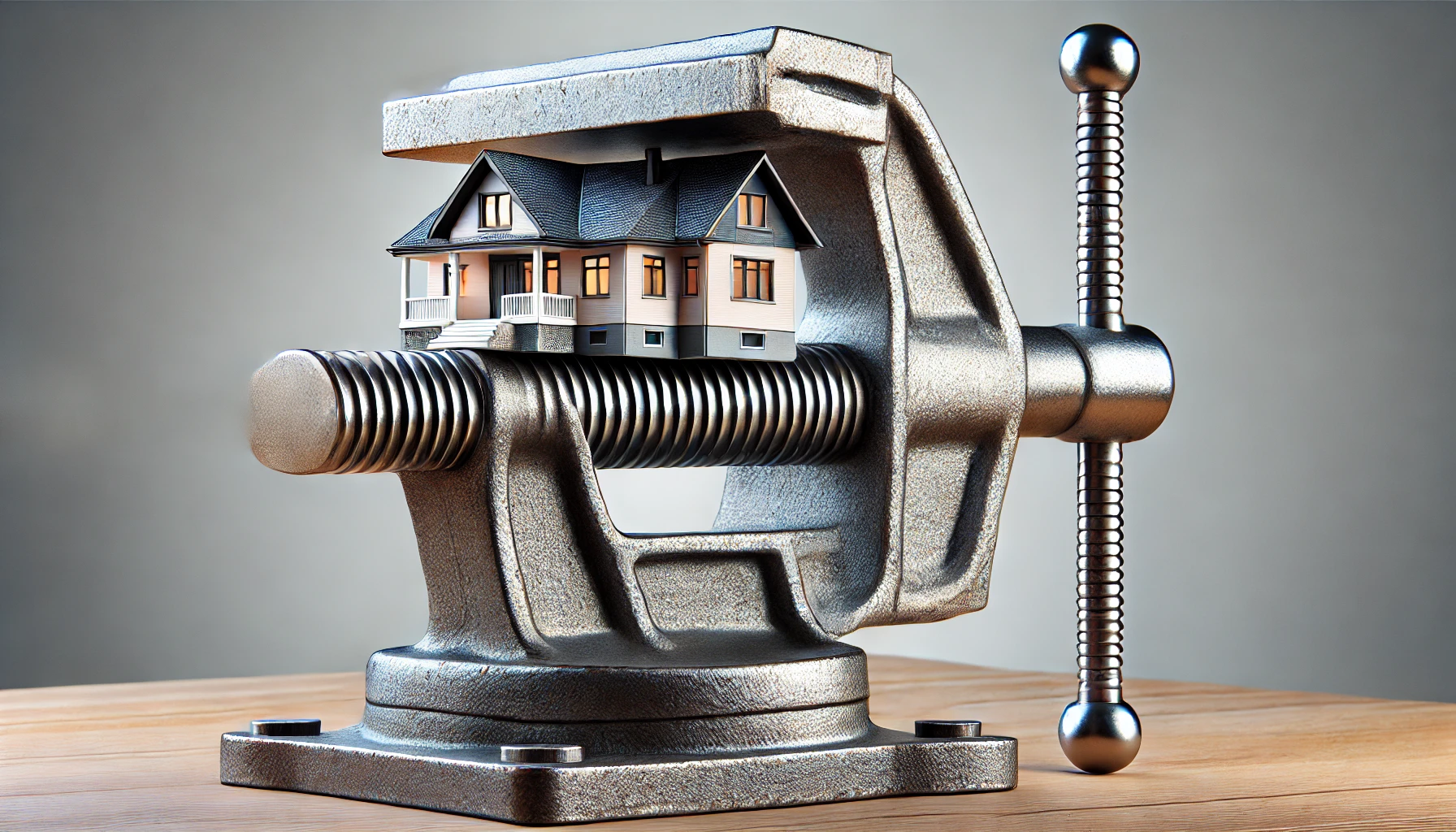

Discover practical strategies to avoid power of sale in Toronto and take control of your financial situation before it’s too late.

The Bank of Canada Rate Cut is lowering borrowing costs and increasing confidence in the real estate market. What does this mean for you as a buyer or seller?

Considering a Mortgage Transfer? Learn how to switch lenders in Toronto for better rates and terms. Explore the benefits of moving your mortgage today.

Discover the Latest Adjustments to the Mortgage Stress Test in Toronto. Stay informed about the changes affecting homeowners.

Find out how homeowners in Toronto can take advantage of lower mortgage rates through strategic refinancing and leveraging home equity.

Explore the pros and cons of the new 30-Year Mortgage Amortization rules for insured mortgages in Canada, and how they affect homebuyers.

Find out how the Bank of Canada’s rate cut to 4.25% presents opportunities and challenges for Toronto’s real estate sector.

Find out how the recent inflation rate increase influences Toronto’s property market and what you need to know to stay ahead.

Discover 10 expert strategies to reduce your mortgage term and save thousands in interest, perfect for Toronto homeowners.

Read about the Bank of Canada’s pivotal decision to cut interest rates, signalling a shift in economic policy and opportunities for borrowers and investors.

2024 Canadian Federal Budget: Addressing Housing Challenges with Comprehensive Measures to Boost Supply, Aid First-Time Buyers, and Protect Renters.

David Silverberg is a highly accomplished real estate professional with over 36 years of experience in the industry. He has spent the 17 years specializing in the Toronto market, working with discerning clients in some of the city’s most exclusive neighborhoods. If you’re looking for a dedicated, experienced, and knowledgeable real estate professional to help you buy or sell a property in Toronto, look no further.

Let me bring a fresh cup of coffee and a comprehensive home evaluation to you.

Sign up now to receive updates on sold properties in your desired neighborhood, block or on your street!

Beat the competition. Get new MLS properties within 15 minutes* of listing upload directly from me.

Blog articles are meant to provide general information only and should not be considered as legal advice. It’s best to consult a real estate attorney and agent for questions related to your own real estate dealings.

* Individual new listing uploads may be delayed beyond 15 minutes based upon the MLS system

Let me introduce myself with a coffee directly to your doorstep