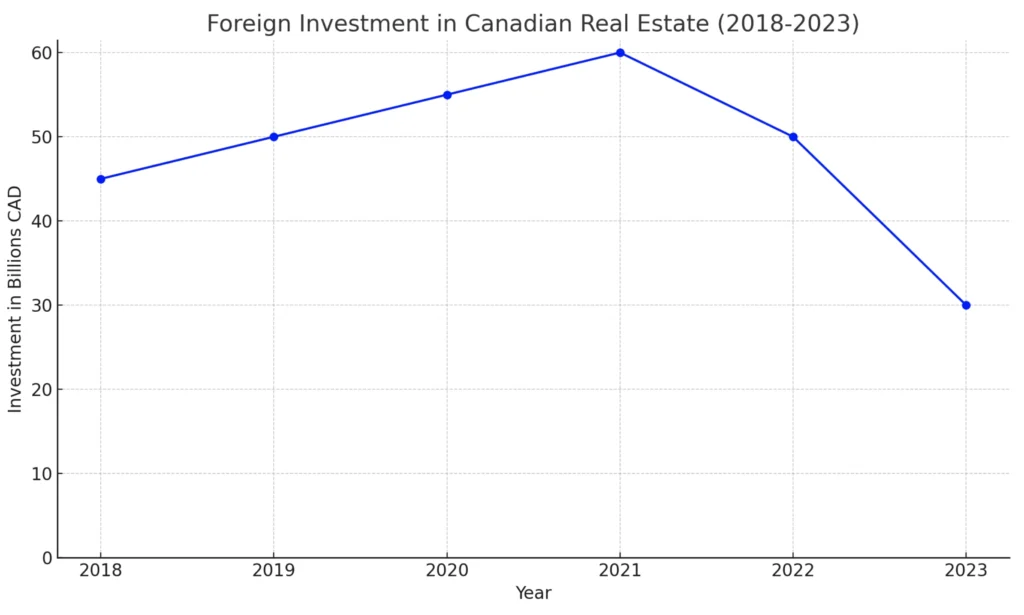

The year 2023 etched itself into Canadian economic history as foreign investors liquidated an unprecedented $48.7 billion in foreign investment Canadian equities. This landmark shift triggered a chain reaction, impacting the Canadian dollar and signalling potential changes in key economic sectors. Early 2024 offers a vantage point to examine the specific repercussions of this trend on the Canadian real estate market, a sector traditionally intertwined with foreign capital flows.

Foreign Investment and Toronto: A Historical Context

Toronto has long been a hub for foreign real estate investment. While this inflow of capital has fueled development, it has also contributed to concerns about affordability. The 2023 sell-off was driven by global factors, but its impact on a city traditionally reliant on international investment warrants careful consideration.

Toronto’s Market in Early 2024: Observations and Trends

While initial fears of a dramatic market downturn haven’t fully materialized, a recalibration is undeniable:

- Price Softening in Select Segments: Certain sectors, particularly the luxury condominium market, have seen price adjustments. However, overall, Toronto’s prices remain elevated.

- Underlying Resilience: Toronto’s robust economic growth, continued immigration, and constrained land supply provide ongoing support for housing demand.

- Neighbourhood-Level Variations: As always, a granular analysis of Toronto’s market is essential. Some neighbourhoods may exhibit more pronounced price sensitivity than others.

Policy Impacts: The Foreign Investment Buyer Ban and Beyond

The foreign buyer ban implemented in 2023 was intended to address market overheating. Its long-term effectiveness remains to be seen. Here’s why:

- Affordability Remains a Challenge: The ban is one policy tool; the affordability crisis requires a comprehensive set of solutions.

- Rental Market Considerations: The ban might inadvertently incentivize investment in multi-unit properties, potentially shaping the city’s rental landscape in the future.

- The Need for Broader Solutions: Policies that emphasize development, increased density, and innovative financing mechanisms will be crucial for fostering a sustainable and equitable market.

Key Focus Areas for 2024

As your agent, I’m prioritizing the following in this evolving market:

- Hyperlocal Market Expertise: Understanding price dynamics at the neighbourhood level is paramount for making strategic decisions.

- Adapting to New Buyer Profiles: The changing investment landscape could bring a shift in buyer profiles. I’m refining my approach to align with potential long-term hold strategies.

- Global Outlook: Monitoring international economic trends and their implications for investment in Toronto real estate is essential.

Conclusion

Toronto’s real estate market is known for its dynamism. The 2023 foreign investment shift underscores the city’s connection to global capital flows. By understanding these complex dynamics, I’m dedicated to empowering you to navigate the Toronto real estate market with clarity and confidence in 2024 and beyond.