Introduction to alternative lending in Toronto’s residential real estate market

The real estate market in Toronto is known for its high prices and competitive nature. As a result, many potential homebuyers face challenges when it comes to securing traditional loans from banks and other financial institutions. This has led to the rise of alternative lending options in the residential real estate market. In this article, I will explore the benefits of alternative lending in Toronto, as well as the challenges and considerations that come with it.*Traditional lending options vs alternative lending options

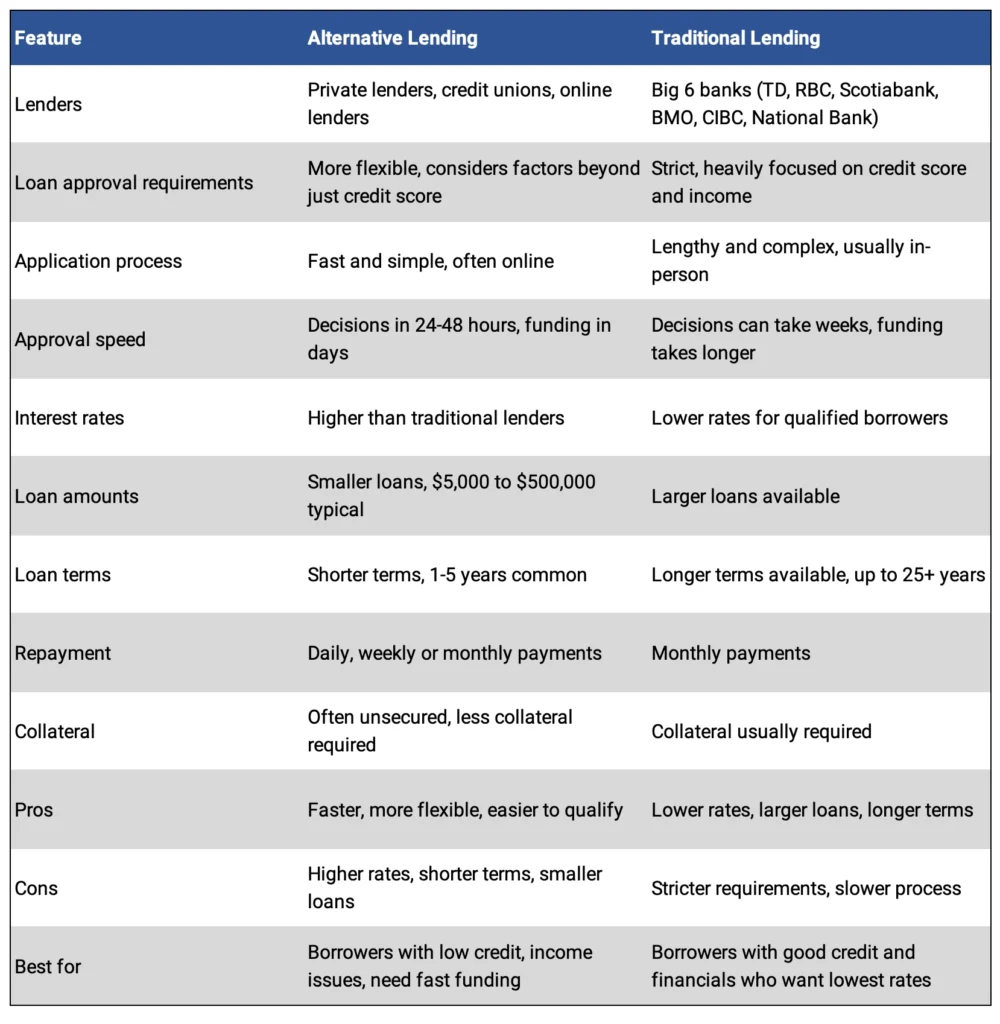

Traditionally, homebuyers would turn to banks for mortgage loans. However, banks have strict criteria and lengthy approval processes, making it difficult for some individuals to qualify. Alternative lending options, on the other hand, provide an alternative solution for those who may not meet the requirements of traditional lenders. These alternative lenders are often private companies or individuals who are willing to take on higher risks in exchange for higher interest rates. While traditional lenders focus on credit scores and income verification, alternative lenders may consider different factors such as the value of the property and the borrower’s overall financial situation.

Benefits of alternative lending in the real estate market

One of the main benefits of alternative lending in Toronto’s residential real estate market is the accessibility it provides to a wider range of homebuyers. Alternative lenders are more flexible in their lending criteria, allowing individuals with less-than-perfect credit scores or non-traditional sources of income to obtain financing. This opens up opportunities for those who may have been previously excluded from the market. Another advantage of alternative lending is the speed at which loans can be processed. Traditional lenders often have lengthy approval processes that can take weeks or even months. Alternative lenders, on the other hand, can provide financing in a matter of days. This is particularly beneficial in a competitive market like Toronto, where properties can be sold quickly.Furthermore, alternative lending options can be tailored to suit the specific needs of borrowers. Traditional lenders often have strict guidelines regarding loan amounts and repayment terms. Alternative lenders, however, can offer more flexibility in these areas. This can be especially useful for individuals who are looking for non-traditional financing options, such as bridge loans or construction loans.

Challenges and considerations when using alternative lending in Toronto

While alternative lending can be a viable option for many homebuyers in Toronto, there are also challenges and considerations to keep in mind. One of the main challenges is the higher interest rates associated with alternative loans. Because alternative lenders take on higher risks, they often charge higher interest rates to compensate. Borrowers need to carefully consider whether the benefits of alternative lending outweigh the additional costs. Another consideration is the potential for predatory lending practices. While there are legitimate alternative lenders in the market, there are also those who may take advantage of vulnerable borrowers. It is important for homebuyers to thoroughly research and vet potential lenders before entering into any agreements. Working with a reputable mortgage broker or real estate lawyer can help ensure that borrowers are protected.Additionally, alternative lending options may come with stricter repayment terms or shorter loan durations. Borrowers need to carefully review and understand the terms of any alternative loan before committing. It is also important to have a solid repayment plan in place to avoid any potential financial difficulties down the line.

Alternative lending options available in Toronto’s residential real estate market

In Toronto, there are several alternative lending options available to homebuyers. Private mortgage lenders are one popular option. These lenders are individuals or companies that provide financing based on the value of the property rather than the borrower’s credit score. Private mortgage lenders can often provide quicker approvals and more flexible financing options.Another alternative lending option is crowdfunding. This involves pooling funds from multiple investors to finance a real estate project. Crowdfunding platforms have gained popularity in recent years, allowing individuals to invest in real estate with lower capital requirements.Additionally, there are alternative lenders who specialize in specific types of loans, such as bridge loans or construction loans. These lenders understand the unique needs of borrowers in these situations and can provide tailored financing solutions.

Alternative lending vs. Big Banks in Toronto’s residential real estate market

How to qualify for alternative lending in the real estate market

Qualifying for alternative lending in the real estate market requires careful preparation and consideration. While the criteria may be less stringent compared to traditional lenders, borrowers still need to demonstrate their ability to repay the loan. Alternative lenders will typically consider factors such as the value of the property, the borrower’s income and assets, and the overall financial situation.To improve the chances of qualifying for alternative lending, borrowers should focus on improving their credit scores and reducing any outstanding debt. It is also important to gather all necessary documentation, such as proof of income and bank statements, to demonstrate financial stability.

Tips for successfully navigating alternative lending in Toronto

Navigating alternative lending in Toronto’s residential real estate market can be a complex process. Here are some tips to help borrowers successfully navigate this alternative financing option:

- Research and compare lenders: Take the time to research and compare different alternative lenders. Look for reputable lenders with a track record of successful transactions. You can reach out to me for some reputable lenders.

- Work with professionals: Consider working with a mortgage broker or real estate lawyer who specializes in alternative lending. They can provide guidance and help navigate the process.

- Understand the terms: Carefully review and understand the terms of any alternative loan before signing. Pay attention to interest rates, repayment terms, and any additional fees.

- Have a repayment plan: Develop a solid repayment plan before obtaining alternative financing. This will help ensure that borrowers can meet their financial obligations.

- Be realistic: Set realistic expectations when it comes to alternative lending. Understand that interest rates may be higher and loan terms may be shorter compared to traditional options.

Working with alternative lenders in the residential real estate market

When working with alternative lenders in Toronto’s residential real estate market, communication and transparency are key. Borrowers should be upfront about their financial situation and goals, and lenders should provide clear and concise information about the terms and conditions of the loan.It is also important to establish a good working relationship with the lender. Building trust and maintaining open lines of communication can help streamline the lending process and ensure a successful transaction.

Conclusion

Alternative lending options have become increasingly popular in Toronto’s residential real estate market, providing opportunities for homebuyers who may not qualify for traditional loans. While there are benefits to alternative lending, it is important for borrowers to carefully consider the challenges and considerations. By understanding the options available, qualifying criteria, and best practices for navigating alternative lending, borrowers can make informed decisions and successfully secure financing for their real estate ventures.